Free Form 941 Erc Download: A Comprehensive Guide

Navigating the complexities of tax filing can be a daunting task, especially for businesses and individuals with limited resources. To simplify this process, the Internal Revenue Service (IRS) has introduced Free Form 941 Erc, a software designed to streamline tax reporting and reduce the burden of compliance. In this comprehensive guide, we will delve into the intricacies of Free Form 941 Erc, exploring its features, benefits, and the seamless download and installation process.

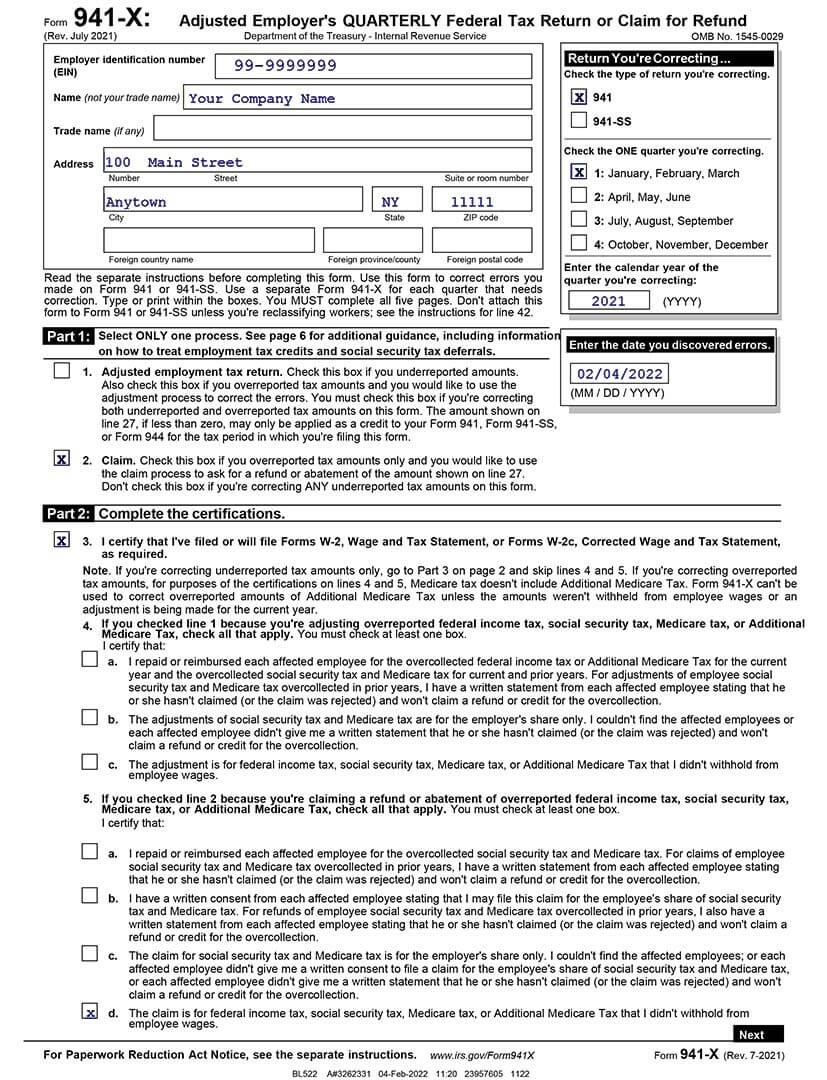

With Free Form 941 Erc, taxpayers can bid farewell to manual calculations and time-consuming paperwork. This user-friendly software automates the preparation and filing of Form 941, Employer’s Quarterly Federal Tax Return, ensuring accuracy and efficiency throughout the process. By leveraging Free Form 941 Erc, businesses can save valuable time, minimize errors, and maintain compliance with tax regulations.

Download Options

Free Form 941 Erc is available for download in a range of file formats to suit different devices and preferences. The most common formats include:

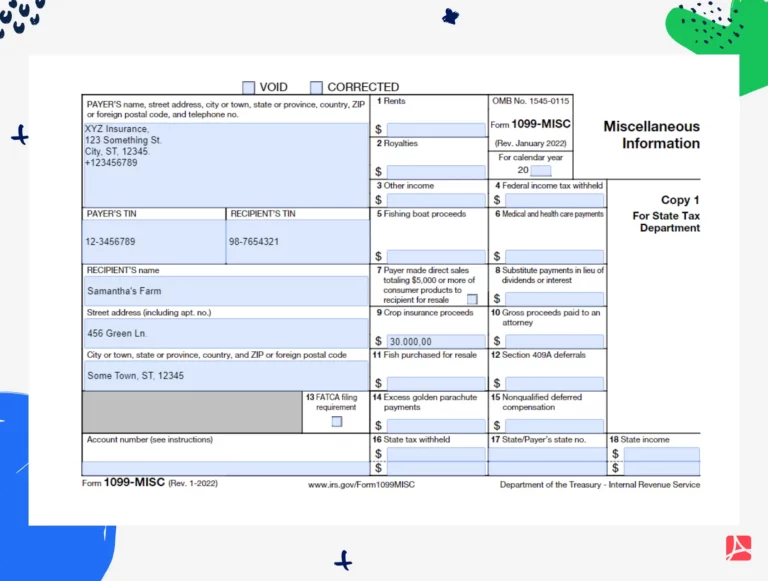

- PDF: The Portable Document Format (PDF) is a versatile format that can be viewed and printed on a variety of devices. It preserves the original formatting and layout of the document, making it ideal for sharing and archiving.

- DOC: The Microsoft Word Document (DOC) format is widely used for creating and editing text documents. It supports a range of formatting options and can be easily opened and edited in Microsoft Word or other compatible software.

- XLS: The Microsoft Excel Spreadsheet (XLS) format is used for creating and editing spreadsheets. It allows users to organize and manipulate data in rows and columns, making it suitable for financial and statistical analysis.

- CSV: The Comma-Separated Values (CSV) format is a simple text-based format that stores data in a tabular format. It is often used for importing and exporting data between different applications.

The specific file format you choose will depend on your intended use and the compatibility of your device. Before downloading, make sure you have the necessary software installed to open and view the file.

Installation s

Installing Free Form 941 Erc is a straightforward process that can be completed in a few simple steps. The installation process may vary slightly depending on your operating system and software version, but the general steps remain the same.

For Windows

To install Free Form 941 Erc on Windows, follow these steps:

- Download the Free Form 941 Erc installer from the official website.

- Double-click on the downloaded file to start the installation process.

- Follow the on-screen prompts to complete the installation.

- Once the installation is complete, you can launch Free Form 941 Erc from the Start menu.

For macOS

To install Free Form 941 Erc on macOS, follow these steps:

- Download the Free Form 941 Erc installer from the official website.

- Double-click on the downloaded file to start the installation process.

- Follow the on-screen prompts to complete the installation.

- Once the installation is complete, you can launch Free Form 941 Erc from the Applications folder.

For Linux

To install Free Form 941 Erc on Linux, follow these steps:

- Download the Free Form 941 Erc installer from the official website.

- Open a terminal window and navigate to the directory where you downloaded the installer.

- Run the following command to install Free Form 941 Erc:

sudo apt install ./free-form-941-erc_x.x.x_amd64.deb

where “x.x.x” is the version number of the installer.

- Once the installation is complete, you can launch Free Form 941 Erc from the terminal window.

Features and Functionality

Free Form 941 Erc is a comprehensive tax filing and reporting software that simplifies the process of submitting Form 941, Employer’s Quarterly Federal Tax Return. Its user-friendly interface and intuitive features make it an ideal choice for businesses and individuals looking to streamline their tax compliance.

With Free Form 941 Erc, you can effortlessly calculate and file your quarterly taxes, including federal income tax, Social Security tax, and Medicare tax. The software automatically calculates your tax liability based on the information you provide, ensuring accuracy and compliance.

Key Features

- Automated Calculations: Free Form 941 Erc automates complex tax calculations, eliminating the need for manual computations and reducing the risk of errors.

- Guided Filing: The software provides step-by-step guidance throughout the filing process, ensuring that you provide all necessary information accurately.

- E-filing Capabilities: Free Form 941 Erc allows you to electronically file your Form 941 directly to the IRS, saving time and postage costs.

- Secure Data Storage: The software securely stores your tax data, providing peace of mind and ensuring compliance with data protection regulations.

- Flexible Reporting Options: Free Form 941 Erc offers various reporting options, including the ability to generate reports in multiple formats for easy sharing and analysis.

Benefits of Using Free Form 941 Erc

- Saves Time: The automated features and guided filing process significantly reduce the time spent on tax preparation and filing.

- Improves Accuracy: The software’s automated calculations and error-checking capabilities minimize the risk of mistakes, ensuring accurate tax reporting.

- Simplifies Compliance: Free Form 941 Erc ensures compliance with IRS regulations, providing peace of mind and avoiding potential penalties.

- Enhances Efficiency: The software streamlines the tax filing process, allowing you to focus on other aspects of your business.

- Cost-Effective: Free Form 941 Erc is an affordable solution that provides value for money, saving you time and money on tax compliance.

Troubleshooting and Support

If you’re havin’ a right mare with Free Form 941 Erc, here’s some bits to help you out.

Contacting Tech Support

If you’re proper stuck, give their crack team a bell on 0800 018 3601. They’re all ears from 8 am to 8 pm, Monday to Friday, innit.

Common Issues and Fixes

- Won’t install: Make sure you’ve got the right version for your comp and that you’re runnin’ it as an administrator, bruv.

- Keeps crashing: Try givin’ your comp a reboot or reinstallin’ the software. If that don’t work, you might need to update your drivers or check if there’s any conflicts with other programs.

- Can’t find my files: Check the default save location and make sure you’ve got the right permissions to access the folder.

Answers to Common Questions

What are the system requirements for Free Form 941 Erc?

Free Form 941 Erc has modest system requirements and can be installed on most computers running Windows 7 or later, or macOS 10.12 or later.

Can I import data from other tax software into Free Form 941 Erc?

Yes, Free Form 941 Erc allows you to import data from various tax software programs, making the transition seamless and hassle-free.

Does Free Form 941 Erc support e-filing?

Yes, Free Form 941 Erc fully supports electronic filing, enabling you to submit your tax returns directly to the IRS.

Is technical support available for Free Form 941 Erc?

Yes, the IRS provides comprehensive technical support for Free Form 941 Erc users. You can access support through the IRS website or by phone.