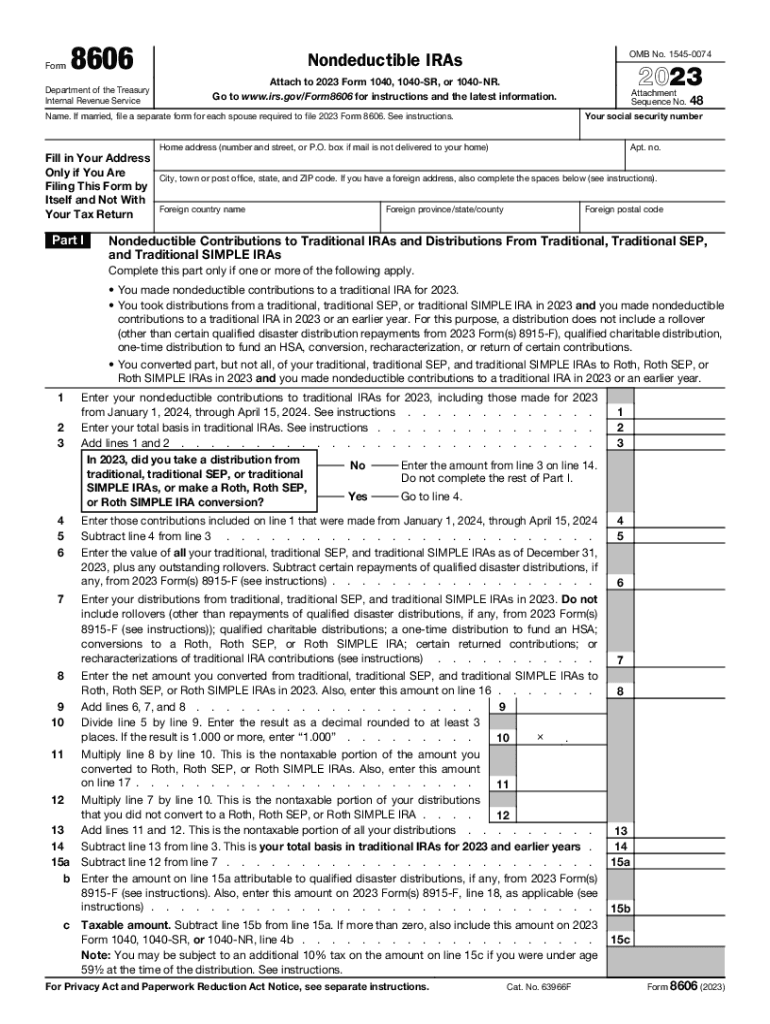

Free Form 8606 Instructions 2024 Download: A Comprehensive Guide

Navigating the complexities of tax reporting can be daunting, but understanding and completing Form 8606 is essential for non-resident aliens and foreign entities seeking to report their U.S. income and avoid double taxation. This comprehensive guide will provide you with a clear understanding of Form 8606, its purpose, and the step-by-step process of downloading, completing, and filing it accurately.

In this guide, we will explore the eligibility criteria, sections, and fields of Form 8606. We will provide you with the official source for downloading the form and its schedules, ensuring you have the correct version for your specific tax year. Additionally, we will offer expert guidance on completing the form, avoiding common errors, and understanding the different filing methods available.

Understanding Free Form 8606

Form 8606, also known as the “Nonresident Alien Income Tax Return”, is a tax form used by nonresident aliens (individuals who are not US citizens or permanent residents) to report their US income and pay any taxes owed. It is a complex form that requires careful completion to ensure accuracy and compliance with US tax laws.

The form consists of several sections and fields, each designed to collect specific information about the taxpayer’s income, deductions, and credits. These sections include personal information, income from various sources, deductions and adjustments, and tax calculation. The form also includes schedules and worksheets that provide additional details about the taxpayer’s financial situation.

To be eligible to file Form 8606, an individual must be a nonresident alien who has income from US sources. This income can include wages, salaries, tips, dividends, interest, and other types of income. Nonresident aliens who have no US income are not required to file Form 8606.

Downloading the Form and s

Getting hold of Form 8606 and its s is a breeze. You can snag ’em straight from the official IRS website, mate.

Official Website and Download Options

- Head over to the IRS website: https://www.irs.gov/forms-pubs/about-form-8606.

- Click on the “Download Form 8606” button.

- Select the correct version of the form based on the tax year you’re filing for.

- Choose the file format you want (PDF, fillable PDF, etc.).

Completing the Form

Filling out Form 8606 is a straightforward process, but there are a few things you need to keep in mind to make sure you do it correctly. Here’s a step-by-step guide to help you out:

Step 1: Personal Information

The first step is to fill in your personal information. This includes your name, address, and contact information. Make sure you write clearly and legibly, and double-check that everything is correct before you move on.

Step 2: Tax Information

Next, you’ll need to provide some basic tax information. This includes your Social Security number, filing status, and the tax year you’re filing for. If you’re not sure about any of this information, you can refer to your tax return or contact the IRS.

Step 3: Income Information

The next section of the form is where you’ll report your income. This includes your wages, salaries, tips, and other taxable income. If you have any deductions or credits, you’ll also need to report them here.

Step 4: Adjustments to Income

After you’ve reported your income, you can make any necessary adjustments to your income. This includes things like student loan interest deductions and IRA contributions.

Step 5: Taxable Income

Once you’ve made any adjustments to your income, you can calculate your taxable income. This is the amount of income that you’ll be taxed on.

Step 6: Tax Calculation

The next step is to calculate your tax liability. This is the amount of tax that you owe to the IRS. To do this, you’ll need to use the tax tables or the tax software that you’re using.

Step 7: Credits and Payments

After you’ve calculated your tax liability, you can claim any credits or payments that you’re eligible for. This includes things like the child tax credit and the earned income tax credit.

Step 8: Refund or Balance Due

Finally, you’ll need to calculate your refund or balance due. If you’re due a refund, the IRS will send you a check or direct deposit the money into your bank account. If you owe a balance due, you’ll need to pay the IRS the amount that you owe.

Common Errors to Avoid

Here are a few common errors to avoid when filling out Form 8606:

- Make sure you write clearly and legibly.

- Double-check that all of your information is correct before you submit the form.

- Use the tax tables or tax software to calculate your tax liability.

- Claim any credits or payments that you’re eligible for.

- Pay the IRS the amount that you owe if you have a balance due.

Filing the Form

Alright, bruv, now that you’ve got your Free Form 8606 sorted, let’s chat about filing it. There are a couple of ways to do it, so listen up.

You can either post it like a snail mail king or file it electronically, which is way quicker. If you’re old-school, send it to the address below:

Mailing Address

Internal Revenue Service

Ogden, UT 84201-0027

But if you’re all about that digital life, head over to the IRS website and file it electronically. Just make sure you do it by the deadline, which is usually around April 15th. If you’re late, you might have to pay some extra dough in penalties, so don’t be a slacker.

Resources and Support

If you need further assistance with Form 8606, there are plenty of resources available to you.

You can contact the IRS directly at 1-800-829-1040 or visit their website at www.irs.gov. There, you can find a wealth of information about Form 8606, including instructions, FAQs, and other helpful resources.

Online Resources and Forums

In addition to the IRS, there are a number of online resources and forums where you can get help with Form 8606.

- The TaxSlayer Community Forum is a great place to ask questions and get answers from other taxpayers and tax professionals.

- The TurboTax Community Forum is another helpful resource, with a dedicated section for Form 8606.

- You can also find a number of helpful articles and videos about Form 8606 on YouTube and other video-sharing websites.

Updates and Revisions

The IRS may update or revise Form 8606 from time to time. To ensure that you have the most up-to-date version of the form, you should always visit the IRS website before filing.

FAQ

What is the purpose of Form 8606?

Form 8606 is used by non-resident aliens and foreign entities to report their U.S. income and claim any applicable tax treaty benefits.

Where can I download Form 8606 and its schedules?

You can download Form 8606 and its schedules from the official IRS website.

What are the eligibility criteria for filing Form 8606?

To be eligible to file Form 8606, you must be a non-resident alien or foreign entity with U.S. income.

What are the different filing methods for Form 8606?

You can file Form 8606 by mail or electronically using the IRS e-file system.