Free Form 1099 2024 Download: Simplify Your Tax Filing Process

As a business owner or freelancer, navigating the complexities of tax filing can be a daunting task. However, the Free Form 1099 2024 Download offers a solution that simplifies the process, ensuring accuracy and efficiency. With its user-friendly interface and comprehensive features, this download empowers you to streamline your tax filing, saving you time and hassle.

Whether you’re a seasoned tax pro or new to the game, the Free Form 1099 2024 Download has everything you need to file your taxes with confidence. Its intuitive design guides you through every step of the process, ensuring you meet all IRS requirements. Get ready to experience the future of tax filing with this powerful tool.

Definition and Explanation

Intro

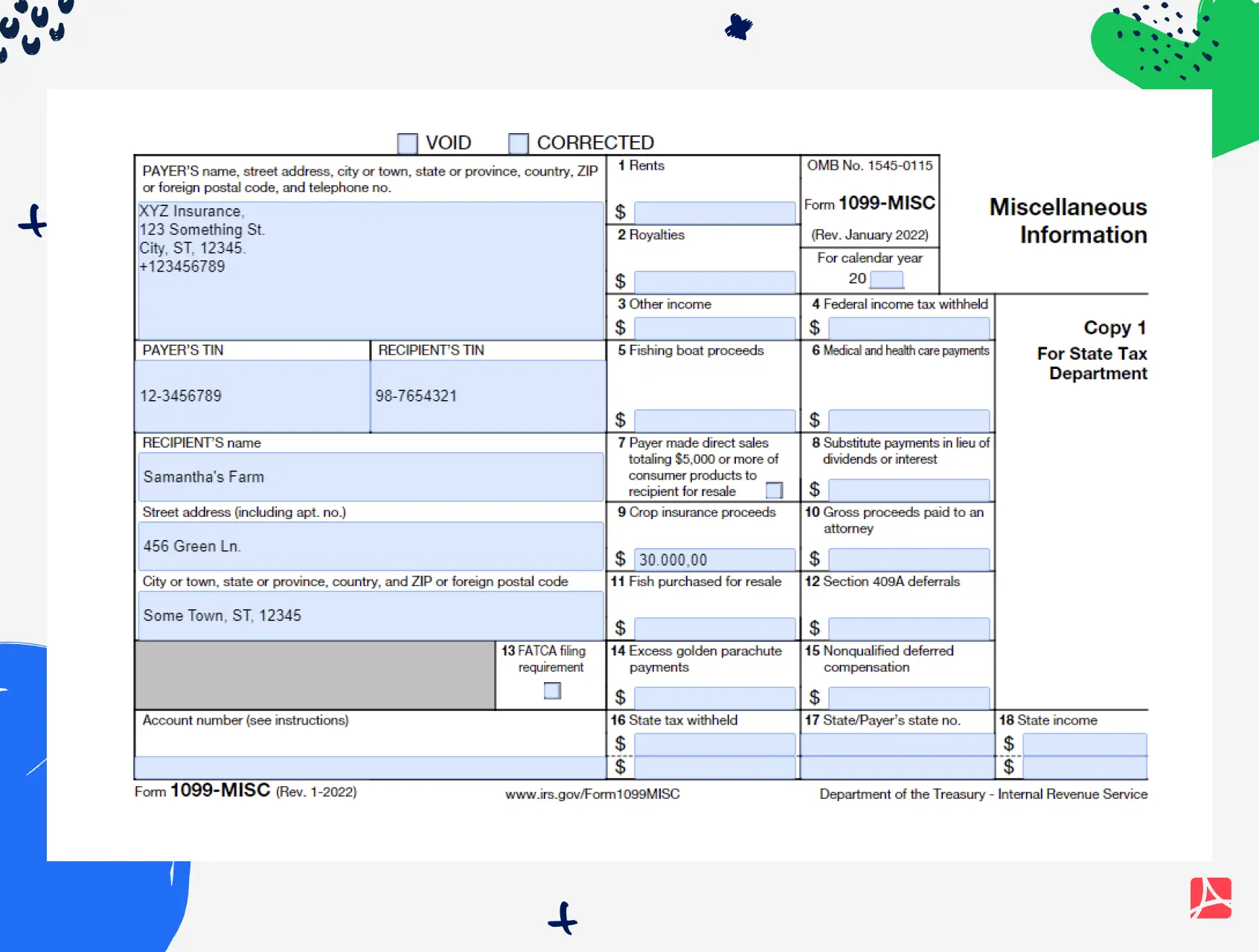

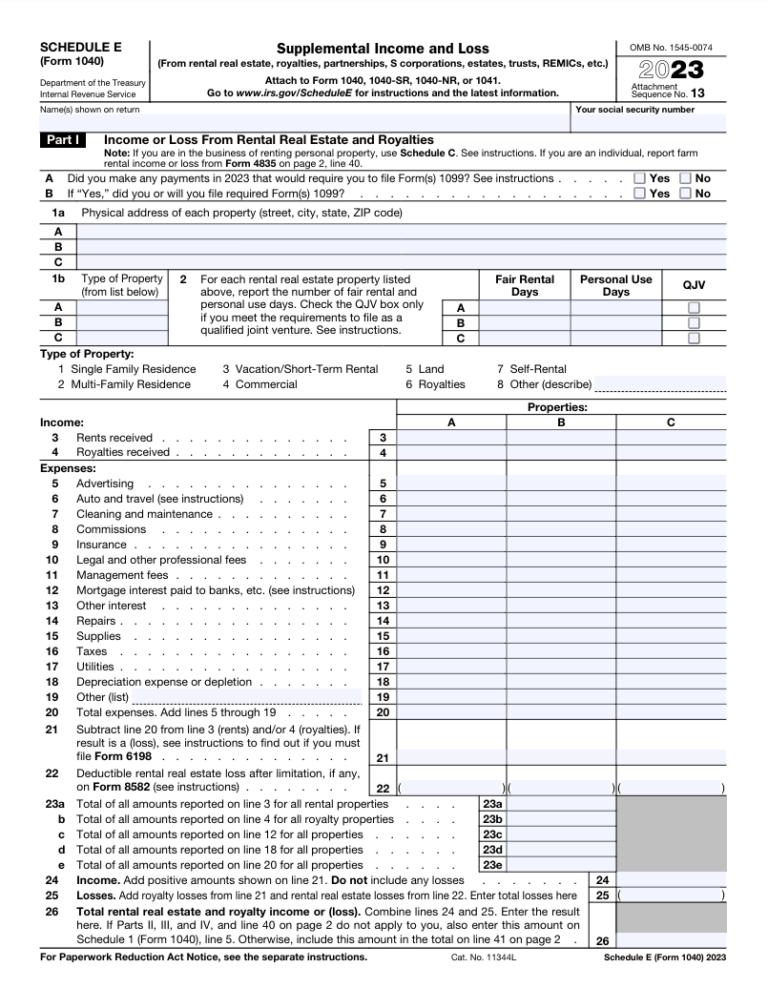

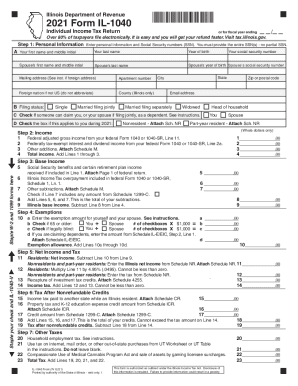

Free Form 1099 2024 Download is a downloadable tax form used to report income earned from self-employment, freelance work, or other non-employee compensation. It’s a popular choice for gig workers, independent contractors, and sole proprietors.

Purpose and Usage

The Free Form 1099 2024 Download allows individuals to easily track and report their self-employment income to the Internal Revenue Service (IRS). It’s essential for ensuring accurate tax filing and avoiding penalties.

Target Audience

The Free Form 1099 2024 Download is primarily intended for individuals who earn income from self-employment or freelance work. It’s commonly used by:

- Freelancers

- Independent contractors

- Sole proprietors

- Gig workers

- Small business owners

Benefits of Using the Download

Using the Free Form 1099 2024 Download offers a range of advantages that simplify and streamline the tax filing process.

Firstly, the download provides an easy-to-use interface that guides you through each step of the tax filing process. This user-friendly design makes it accessible to individuals of all levels of tax knowledge.

Accuracy and Reliability

The Free Form 1099 2024 Download is highly accurate and reliable. It automatically calculates your taxes based on the information you provide, ensuring that your return is error-free.

Frequently Asked Questions (FAQs)

If you have any questions regarding the Free Form 1099 2024 Download, we’ve compiled a list of frequently asked questions (FAQs) below along with their comprehensive answers. Use the accordion tabs to easily navigate through the questions and find the information you need.

Remember, if you have any further questions or require additional assistance, don’t hesitate to reach out to our support team for guidance.

What are the system requirements for using the Free Form 1099 2024 Download?

To ensure a seamless experience, make sure your computer meets the following minimum system requirements:

- Operating System: Windows 10 or later, macOS 10.15 or later

- Processor: Intel Core i5 or equivalent

- Memory (RAM): 8GB or more

- Storage: 500MB of available hard disk space

- Internet Connection: Stable internet connection for downloading and updates

How do I download and install the Free Form 1099 2024 Download?

Downloading and installing the Free Form 1099 2024 Download is a straightforward process. Here’s how you can do it:

- Visit the official website or authorized download portal.

- Locate the download link for the Free Form 1099 2024 Download.

- Click on the download link and save the installation file to your computer.

- Once the download is complete, locate the installation file and double-click on it to begin the installation process.

- Follow the on-screen instructions to complete the installation.

- CSV (Comma-Separated Values)

- TXT (Text File)

- XML (Extensible Markup Language)

- PDF (Portable Document Format)

- Online Help: Access the user manual or online documentation for guidance.

- Email Support: Send an email to the support team with your query.

- Live Chat: Engage in a live chat session with a support representative.

- Phone Support: Call the support hotline for immediate assistance.

- It’s free to download and use.

- It’s easy to use, even if you’re not a tax expert.

- It helps you to avoid errors when filing your taxes.

- It can save you time and money.

Can I use the Free Form 1099 2024 Download on multiple computers?

The Free Form 1099 2024 Download is licensed for use on a single computer. If you need to use it on multiple computers, you will need to purchase separate licenses for each computer.

What file formats does the Free Form 1099 2024 Download support?

The Free Form 1099 2024 Download supports a wide range of file formats, including:

How do I get support for the Free Form 1099 2024 Download?

If you encounter any issues or have questions while using the Free Form 1099 2024 Download, you can get support through the following channels:

Questions and Answers

What is the Free Form 1099 2024 Download?

The Free Form 1099 2024 Download is a software application that allows you to create and file Form 1099s, which are used to report payments made to independent contractors and other non-employees.

What are the benefits of using the Free Form 1099 2024 Download?

There are many benefits to using the Free Form 1099 2024 Download, including:

How do I download and use the Free Form 1099 2024 Download?

You can download the Free Form 1099 2024 Download from the IRS website. Once you have downloaded the software, you can install it on your computer and begin using it to create and file your Form 1099s.

What are the system requirements for the Free Form 1099 2024 Download?

The Free Form 1099 2024 Download is compatible with Windows, Mac, and Linux operating systems. It requires a minimum of 512MB of RAM and 10MB of hard drive space.

Where can I get help with the Free Form 1099 2024 Download?

If you need help with the Free Form 1099 2024 Download, you can visit the IRS website or contact the IRS by phone at 1-800-829-1040.