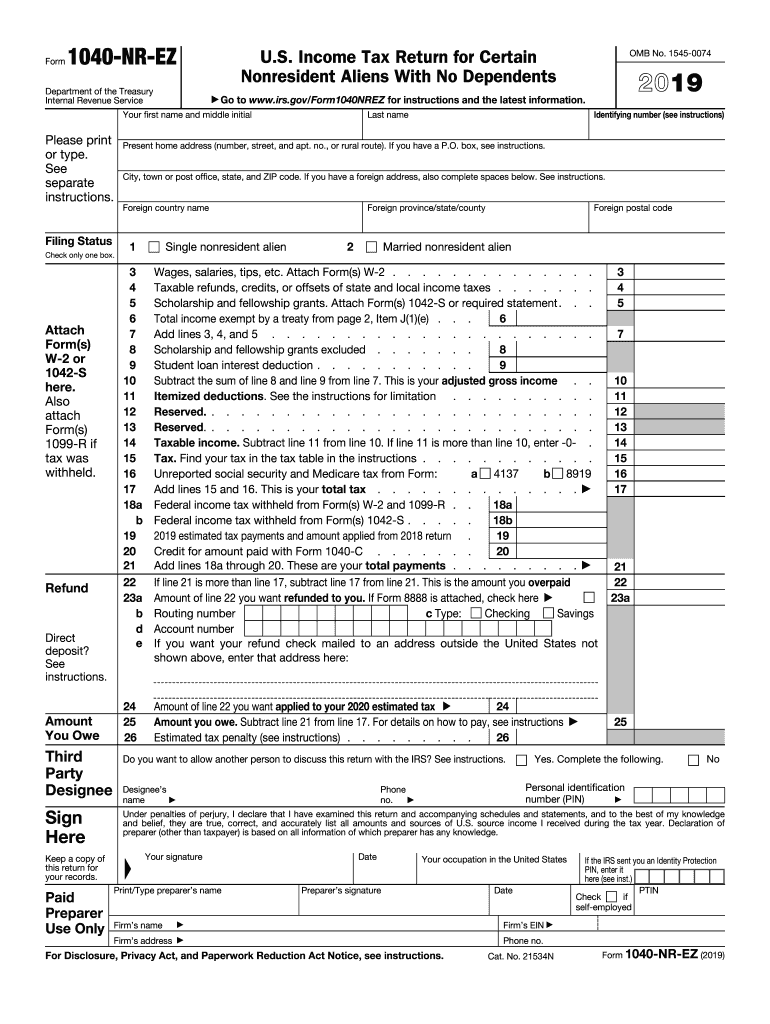

Free Form 1040nr-ez Download: A Comprehensive Guide

Navigating the complexities of tax filing can be daunting, especially for non-resident aliens. However, the Free Form 1040nr-ez provides a simplified solution for individuals who need to file US income taxes. This comprehensive guide will walk you through the process of downloading, completing, and filing the Free Form 1040nr-ez, ensuring a seamless and accurate tax filing experience.

Whether you’re a student, a temporary worker, or an investor with US-sourced income, understanding the Free Form 1040nr-ez is crucial for fulfilling your tax obligations and avoiding potential penalties.

Introduction

The Free Form 1040nr-ez is a tax form used by non-resident aliens to file their US income taxes. It is a simplified version of the regular 1040 form and is designed to make it easier for non-resident aliens to comply with their US tax obligations.

Non-resident aliens are individuals who are not citizens or residents of the United States. They are typically subject to US income tax on their US-source income, such as wages, salaries, tips, and investment income. The Free Form 1040nr-ez allows non-resident aliens to report their US-source income and pay any taxes due in a simplified manner.

Who Should Use This Form?

The Free Form 1040nr-ez is designed for non-resident aliens who meet the following criteria:

- You are not a citizen or resident of the United States.

- You have US-source income that is not effectively connected with a US trade or business.

- Your gross income for the year is less than $50,000.

- You do not have any dependents who are US citizens or residents.

- You are not claiming any deductions or credits other than the standard deduction.

Downloading the Form

Downloading the Form 1040NR-EZ from the IRS website is a straightforward process that can be completed in a few simple steps.

[detailed content here]

- Step 1: Visit the IRS website at https://www.irs.gov/forms-pubs/about-form-1040nr-ez

- Step 2: Click on the “Download” button under the “Forms” tab.

- Step 3: Select the appropriate year for the form you need to download.

- Step 4: Click on the “PDF” link to download the form.

- Step 5: Save the form to your computer.

Completing the Form

Alright, now let’s dive into filling out this form, bruv. It’s a bit of a maze, but we’ll guide you through each section, innit.

Personal Information

Kick things off with your personal deets, like your name, addy, and tax ID number. Make sure it’s all up to scratch, yeah?

Income

Time to spill the beans on your earnings. List all the different sources of income you had during the year, like wages, investments, and any other bits and bobs.

Deductions

Now, let’s talk about deductions. These are expenses you can subtract from your income to reduce your taxable amount. Check the form for a list of eligible deductions, like charitable donations or mortgage interest.

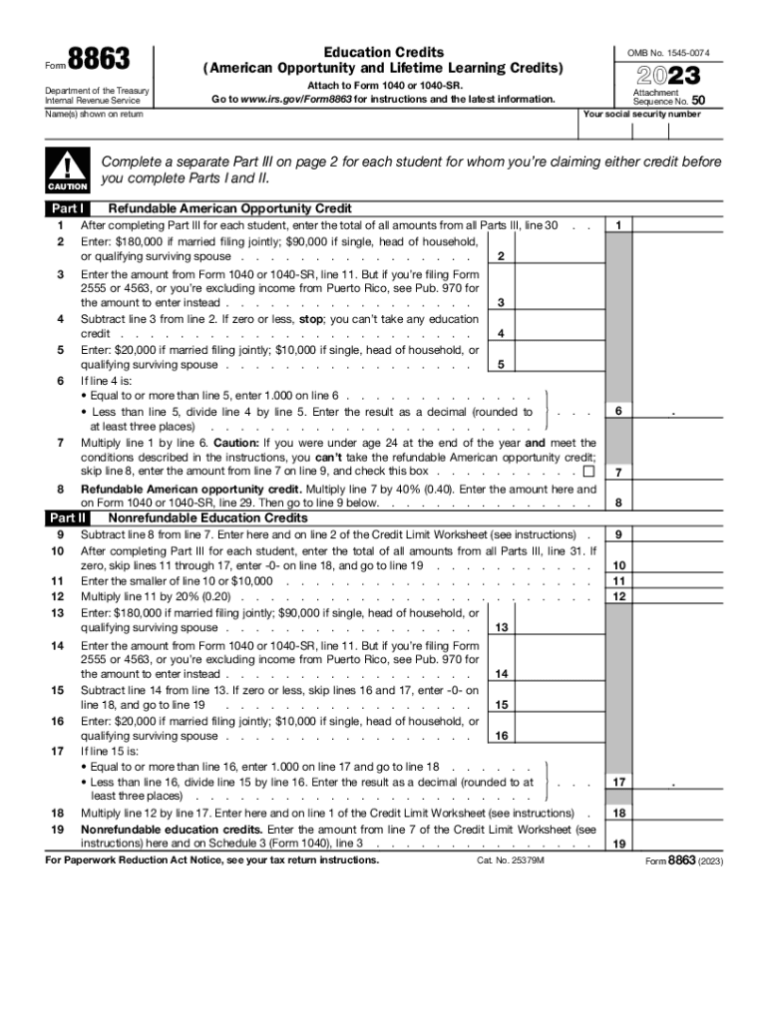

Credits

Credits are like discounts on your taxes, mate. They can further reduce your tax liability. Again, check the form for a list of available credits, like the child tax credit or the foreign tax credit.

Tax Calculation

This is where the magic happens. Based on your income, deductions, and credits, the form will calculate how much tax you owe.

Payment or Refund

If you owe tax, you’ll need to pay it by the deadline. But if you’re due a refund, you’ll get a nice little bonus back from the taxman.

Filing the Form

There be various ways to file your 1040NR-EZ form. You can do it by post, electronically, or through tax preparation software.

Each method has its own advantages and disadvantages. Here’s a quick rundown:

By Mail

- Pros: It’s free, and you don’t need any special software or equipment.

- Cons: It can take several weeks for your return to be processed, and you won’t be able to track its status online.

Electronically

- Pros: It’s faster than mailing your return, and you can track its status online.

- Cons: You may have to pay a fee to file electronically, and you’ll need to have a computer and an internet connection.

Tax Preparation Software

- Pros: It can help you to prepare your return accurately and quickly. Some software programs even offer free e-filing.

- Cons: You may have to pay for the software, and you’ll need to have a computer and an internet connection.

Common Errors

Filling out the Free Form 1040nr-ez can be tricky, but don’t fret, bruv. Here are some common mistakes to watch out for and tips to avoid them, so you can file your taxes like a pro.

First off, make sure you’re using the right form. The Free Form 1040nr-ez is only for non-resident aliens who meet specific criteria. If you’re not sure if you qualify, check out the IRS website or consult a tax professional.

Once you’ve got the right form, take your time filling it out. Don’t rush through it or you might make a mistake. If you’re not sure about something, refer to the instructions or seek professional guidance.

Incorrect Calculations

One of the most common errors is making mistakes in calculations. This can happen when you’re trying to figure out your income, deductions, or tax liability. To avoid this, use a calculator and double-check your work. If possible, have someone else review your calculations as well.

Missing Information

Another common error is leaving out required information. This can cause your tax return to be delayed or even rejected. Make sure you fill out all of the required fields on the form, including your name, address, and Social Security number. If you’re not sure what information is required, refer to the instructions or seek professional guidance.

Incorrect Filing Status

Your filing status can affect your tax liability. Make sure you choose the correct filing status based on your marital status and residency. If you’re not sure what your filing status is, refer to the instructions or seek professional guidance.

Late Filing

Filing your tax return late can result in penalties and interest charges. Make sure you file your return by the deadline, which is April 15th for most taxpayers. If you can’t file by the deadline, you can file for an extension. However, you will still need to pay any taxes you owe by the deadline.

Avoiding These Errors

Avoiding these common errors is essential for filing your Free Form 1040nr-ez correctly. By taking your time, being careful, and seeking professional guidance when needed, you can ensure that your tax return is accurate and complete.

Additional Resources

Yo, check it, if you need some extra help, the IRS got your back. They’ve got a bunch of resources to make filing your 1040NR-EZ a breeze.

First off, they’ve got FAQs and support channels where you can get your questions answered by real people. No more scratching your head in confusion, fam.

IRS Resources

- IRS website: https://www.irs.gov/forms-pubs/about-form-1040nr-ez

- IRS FAQs: https://www.irs.gov/newsroom/frequently-asked-questions-about-the-form-1040nr-ez

- IRS support channels: https://www.irs.gov/help/contact-your-local-irs-office

Professional Help

If you’re still struggling, don’t be afraid to reach out to a tax professional. They can help you navigate the ins and outs of filing your 1040NR-EZ and make sure you’re getting the most out of your tax return.

FAQ Section

What is the purpose of the Free Form 1040nr-ez?

The Free Form 1040nr-ez is a simplified tax form designed for non-resident aliens who have US-sourced income but do not qualify for the standard 1040NR form.

Who should use the Free Form 1040nr-ez?

Non-resident aliens with US income that falls below certain thresholds and who meet specific criteria should use the Free Form 1040nr-ez.

Where can I download the Free Form 1040nr-ez?

The Free Form 1040nr-ez can be downloaded from the IRS website: https://www.irs.gov/forms-pubs/about-form-1040-nr-ez

What information do I need to complete the Free Form 1040nr-ez?

You will need your personal information, income details, and any applicable deductions and credits to complete the Free Form 1040nr-ez.

How do I file the Free Form 1040nr-ez?

You can file the Free Form 1040nr-ez by mail, electronically, or through tax preparation software.