Free Colorado State Tax Form 2024 Download: A Comprehensive Guide

Navigating the complexities of tax filing can be a daunting task, but it doesn’t have to be. With the Colorado State Tax Form 2024, you have a user-friendly tool at your disposal to ensure accurate and timely tax reporting. This comprehensive guide will provide you with all the essential information you need to download, understand, and complete the Colorado State Tax Form 2024.

The Colorado State Tax Form 2024 is a crucial document for Colorado residents to fulfill their tax obligations. It allows you to report your income, deductions, and credits to the state of Colorado. By understanding the form’s structure, filing options, and available deductions and credits, you can maximize your tax savings and avoid potential penalties.

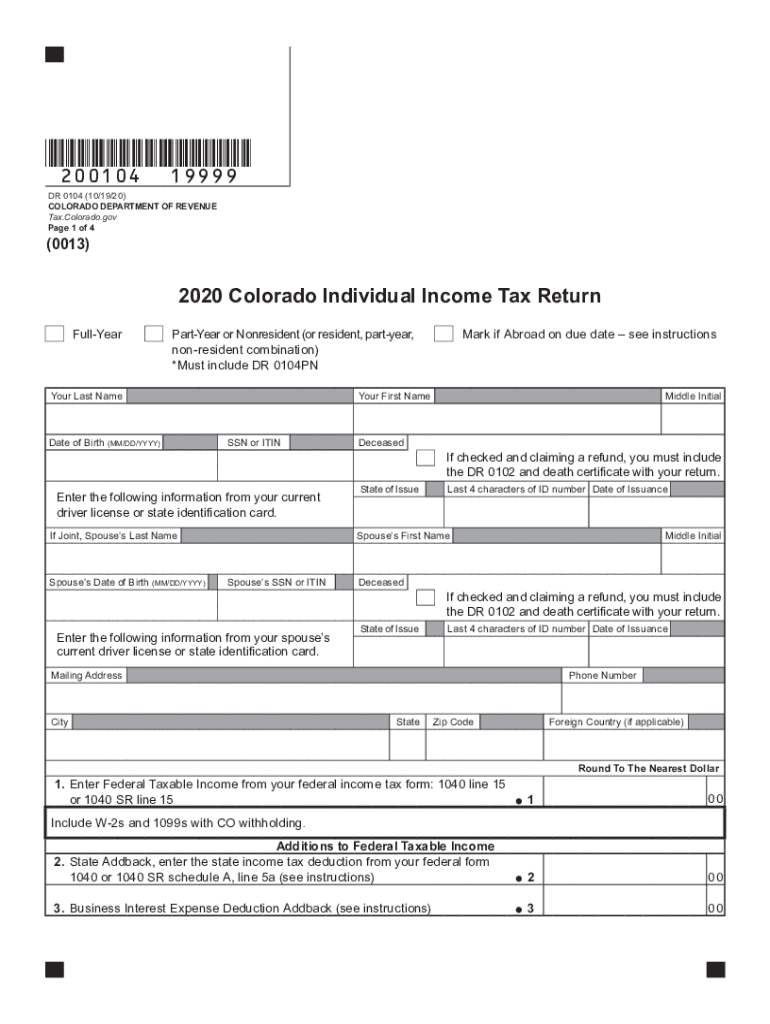

Free Colorado State Tax Form 2024 Download

Sorted, mate! The Colorado State Tax Form 2024 is the official document you need to file your state income taxes. It’s like a passport to getting your taxes sorted, innit? And guess what? You can bag it for free, no sweat.

To get your mitts on this form, simply head over to the Colorado Department of Revenue website. It’s like a treasure hunt, but instead of gold, you’re after a tax form. Once you’re there, you can download the form as a PDF or print it out, whichever floats your boat.

Now, here’s the lowdown on who can download the form: anyone who needs to file Colorado state income taxes. That includes residents, part-timers, and even non-residents who have Colorado income. So, if you’ve been earning bread in the Centennial State, this form’s for you, bruv.

Understanding the Form’s Structure and Contents

The Colorado State Tax Form 2024 is organized into sections that guide you through the tax filing process. Understanding the layout and key sections will help you complete the form accurately and efficiently.

Layout and Organization

The form consists of multiple pages with clear headings and instructions. The main sections include:

- Personal Information and Filing Status

- Income

- Deductions and Credits

- Tax Computation

- Payments and Refunds

Completing Each Section

Personal Information and Filing Status

This section collects your personal details, such as name, address, and Social Security number. It also asks about your filing status, which determines your tax rates and deductions.

Income

Report all sources of income, including wages, salaries, investments, and self-employment income. Use the corresponding schedules to provide detailed information.

Deductions and Credits

Deductions reduce your taxable income, while credits directly lower your tax liability. Carefully review the available deductions and credits to maximize your savings.

Tax Computation

This section calculates your tax liability based on your income, deductions, and credits. Follow the instructions carefully to ensure accurate calculations.

Payments and Refunds

Report any tax payments you’ve made and any refunds you’re claiming. If you owe additional tax, you’ll need to make a payment with your return.

Additional Resources and Support

If you need help with the Colorado State Tax Form 2024, there are many resources available to you.

The Colorado Department of Revenue (CDOR) has a website with a lot of information about the form, including instructions and FAQs. You can also contact the CDOR by phone or email.

In addition, there are many online forums and community groups where you can connect with other taxpayers and exchange information. These forums can be a great way to get help with specific questions or to learn about new tax laws.

Contact Information

Colorado Department of Revenue

1313 Sherman Street, Room 201

Denver, CO 80203

Phone: (303) 233-4100

Email: [email protected]

Online Resources

* CDOR website: https://www.colorado.gov/revenue

* CDOR instructions for Form 2024: https://www.colorado.gov/revenue/sites/revenue/files/DR1132.pdf

* CDOR FAQs for Form 2024: https://www.colorado.gov/revenue/faqs-colorado-individual-income-tax-form-2024

Online Forums and Community Groups

* Colorado Tax Forum: https://www.coloradoforum.com/threads/taxes.37/

* Colorado Taxes subreddit: https://www.reddit.com/r/ColoradoTaxes/

FAQs

Where can I download the Colorado State Tax Form 2024?

You can download the Colorado State Tax Form 2024 from the Colorado Department of Revenue website.

What are the filing deadlines for the Colorado State Tax Form 2024?

The filing deadline for the Colorado State Tax Form 2024 is April 15th, 2024. However, if you file for an extension, you have until October 15th, 2024, to file your return.

What are some common deductions and credits that I can claim on my Colorado State Tax Form 2024?

Some common deductions and credits that you can claim on your Colorado State Tax Form 2024 include the standard deduction, the child tax credit, and the earned income tax credit.