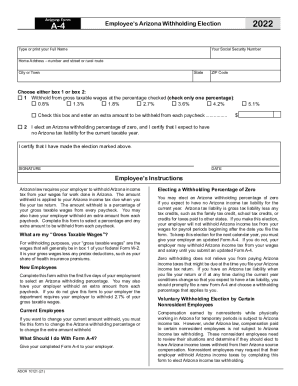

Free Arizona A-4 Form 2024 Download: A Comprehensive Guide

Navigating the complexities of tax filing can be a daunting task. However, with the right resources and guidance, it can be a relatively straightforward process. The Arizona A-4 Form 2024 is an essential document for Arizona taxpayers, and understanding its purpose and how to complete it accurately can significantly impact your tax liability. This comprehensive guide provides you with everything you need to know about the Arizona A-4 Form 2024, including a direct download link, eligibility criteria, a step-by-step filling guide, and valuable resources for assistance.

The Arizona A-4 Form 2024 is a crucial tax document used to calculate your Arizona income tax withholding. By utilizing the most up-to-date version of the form, you ensure that your withholding is accurate, potentially saving you from overpaying or underpaying taxes. Moreover, it helps streamline your tax filing process, reducing the risk of errors and ensuring a smooth submission.

Arizona A-4 Form 2024 Resources

Bruv, if you’re gassed about the Arizona A-4 Form 2024, check out these sick resources that’ll sort you right out. These lot will give you the lowdown on everything you need to know about this peng form, so you can fill it in like a pro and avoid any aggro with the taxman.

Contact Information

- Arizona Department of Revenue: 602-716-6000

- Email: [email protected]

Online Tutorials and Educational Materials

If you’re more of a visual learner, these online tutorials and educational materials will help you get your head around the Arizona A-4 Form 2024 in no time:

- Arizona Department of Revenue: Arizona A-4 Form 2024 Instructions

- YouTube: How to Fill Out the Arizona A-4 Form 2024

FAQ Summary

Where can I download the Arizona A-4 Form 2024?

You can download the Arizona A-4 Form 2024 directly from the Arizona Department of Revenue website: [Insert Download Link].

Who is eligible to use the Arizona A-4 Form 2024?

The Arizona A-4 Form 2024 is available for use by Arizona residents who are required to file an Arizona income tax return.

What are the consequences of not using the Arizona A-4 Form 2024?

Not using the Arizona A-4 Form 2024 may result in incorrect withholding calculations, leading to potential overpayment or underpayment of taxes. This can result in penalties and interest charges.