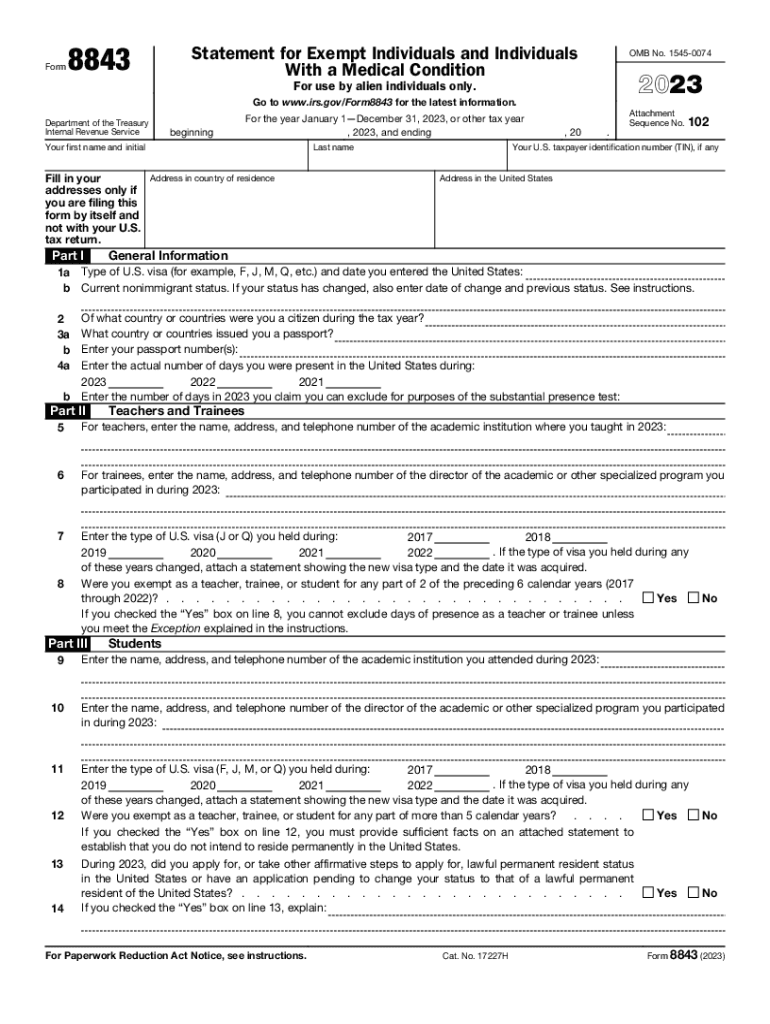

Free 8843 Form 2024 Download: A Comprehensive Guide

Filing taxes can be a daunting task, but it’s essential to ensure compliance and maximize your tax savings. Form 8843 is a crucial document that helps you report certain transactions to the IRS. In this comprehensive guide, we will provide you with everything you need to know about Form 8843, including its purpose, how to download the latest version for 2024, and step-by-step instructions for filing it accurately.

Form 8843 is an important tax document that is used to report various types of transactions, including like-kind exchanges, involuntary conversions, and certain casualty and theft losses. By understanding the purpose and significance of this form, you can ensure that you are meeting your tax obligations and avoiding any potential penalties or audits.

Free 8843 Form 2024 Download

Yo, need to get your hands on Form 8843 for 2024? No stress, fam. We got you covered. This form is the lowdown on your health insurance coverage, so you can file your taxes like a boss. Let’s dive in and show you how to download it in a jiffy.

Downloading Form 8843

Ready to get your hands on Form 8843? Here’s the scoop:

- Head over to the IRS website: It’s like the official hub for all things tax-related.

- Search for “Form 8843”: Type it in the search bar, and it’ll pop right up.

- Click on “Download Form 8843”: It’s usually a blue button or link.

- Choose your format: You can download it as a PDF or HTML file. Pick the one that suits you best.

- Save it to your computer: Find a safe spot on your laptop or desktop to store the file.

Understanding Form 8843

Form 8843 is a tax form used to report certain types of income and expenses. It’s important to understand the key sections and fields of the form to complete it accurately.

The form is divided into several sections, including:

– Part I: General Information – This section includes information about the taxpayer, such as their name, address, and Social Security number.

– Part II: Income – This section includes information about the taxpayer’s income, such as wages, salaries, tips, and self-employment income.

– Part III: Adjustments to Income – This section includes information about any adjustments to the taxpayer’s income, such as deductions for contributions to a retirement account.

– Part IV: Taxable Income – This section includes the taxpayer’s taxable income, which is their income minus any adjustments.

– Part V: Tax – This section includes the taxpayer’s tax liability, which is the amount of tax they owe.

– Part VI: Payments and Credits – This section includes information about any payments or credits that the taxpayer has made, such as estimated tax payments or the child tax credit.

– Part VII: Other Information – This section includes any other information that the taxpayer needs to provide, such as information about their dependents or their filing status.

It’s important to provide all of the required information on Form 8843 accurately and completely. If you’re not sure how to complete a particular section of the form, you can consult the IRS instructions or seek professional help from a tax preparer.

Filing s

Filing Form 8843 is a crucial step to claim the IRC Section 179 deduction for qualified equipment and property. It’s a straightforward process that can be done electronically or via paper submission. Understanding the filing deadlines and potential penalties for late filing is essential to avoid any issues with the IRS.

Electronic Filing

Electronic filing is the most convenient and recommended method to submit Form 8843. It allows for quick and secure transmission of your tax information directly to the IRS.

To file electronically, you’ll need to use IRS-approved software or a tax professional who offers electronic filing services.

Paper Filing

If electronic filing isn’t an option, you can still submit Form 8843 via paper mail. However, paper filing takes longer to process and is more prone to errors.

To file by mail, complete Form 8843 and mail it to the IRS address provided on the form instructions.

Filing Deadlines

Form 8843 must be filed by the due date of your tax return, including any extensions. The standard due date for most individuals is April 15th. However, if you file for an extension, the due date for Form 8843 is the same as your extended tax return due date.

Penalties for Late Filing

Filing Form 8843 late can result in penalties. The IRS may charge a late filing fee, which is a percentage of the tax due on the form. Additionally, if you fail to file Form 8843 altogether, you may be subject to a failure-to-file penalty, which is a higher percentage of the tax due.

Benefits and Implications

Filing Form 8843 offers substantial advantages. Primarily, it enables taxpayers to reduce their tax liability by claiming deductions and credits associated with foreign income and activities. Additionally, it ensures compliance with tax regulations, reducing the risk of penalties and audits.

Consequences of Non-Compliance

Failure to file Form 8843 can lead to severe repercussions. Taxpayers may face substantial penalties for underpayment of taxes. Moreover, the Internal Revenue Service (IRS) may initiate audits, which can be time-consuming and costly. In extreme cases, non-compliance can result in criminal charges.

Real-life examples demonstrate the dire consequences of neglecting Form 8843. One such instance involves an individual who failed to report foreign income. As a result, they were hit with hefty penalties and back taxes, along with the stress and inconvenience of an IRS audit.

By contrast, individuals who diligently file Form 8843 can enjoy peace of mind knowing that they are fulfilling their tax obligations and maximizing their tax savings.

Resources and Support

Need help with Form 8843? No stress, mate. We’ve got you covered with a sick list of resources and support options:

IRS Hotline:

0300 200 3300 (Monday-Friday, 8 am to 6 pm ET)

IRS Website:

https://www.irs.gov/forms-pubs/about-form-8843

Online Forums:

Connect with other filers and tax experts on online forums like Reddit’s /r/tax or Bogleheads.org.

Tax Software:

Use tax software like TurboTax or H&R Block to guide you through Form 8843.

FAQ

What is the purpose of Form 8843?

Form 8843 is used to report certain transactions to the IRS, including like-kind exchanges, involuntary conversions, and certain casualty and theft losses.

Where can I download the latest version of Form 8843?

You can download the latest version of Form 8843 from the IRS website at https://www.irs.gov/forms-pubs/about-form-8843.

What information do I need to complete Form 8843?

To complete Form 8843, you will need information about the transaction being reported, such as the date of the transaction, the type of transaction, and the amount of gain or loss involved.

What are the deadlines for filing Form 8843?

Form 8843 must be filed with your tax return by the April 15th deadline. However, if you are filing an extension, you have until October 15th to file Form 8843.