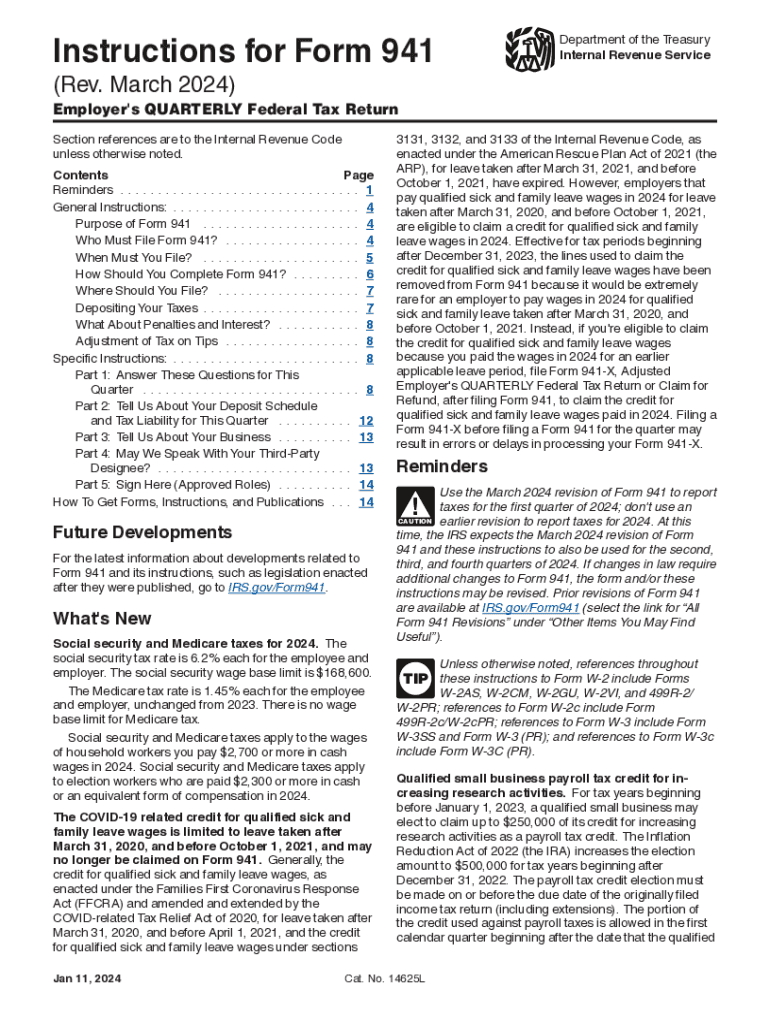

Free 941 Form 2024 Instructions Download: A Comprehensive Guide

Navigating the intricacies of tax filing can be a daunting task, but with the right guidance, it doesn’t have to be. This comprehensive guide provides a clear and concise overview of the 941 Form, its importance, and how to complete it accurately. By understanding the purpose, requirements, and step-by-step instructions, you can ensure that your quarterly tax returns are filed seamlessly and on time.

The 941 Form, known as the Employer’s Quarterly Federal Tax Return, plays a crucial role in reporting and paying federal taxes withheld from employees’ wages. Understanding the ins and outs of this form is essential for businesses and organizations to fulfill their tax obligations and avoid potential penalties.

Understanding the 941 Form

Form 941, also known as Employer’s Quarterly Federal Tax Return, is a crucial document used to report federal income tax, Social Security tax, and Medicare tax withheld from employees’ wages. Filing this form is mandatory for businesses that meet specific criteria, ensuring compliance with tax regulations and timely payment of these taxes to the Internal Revenue Service (IRS).

Who Must File Form 941?

The responsibility of filing Form 941 falls upon businesses that:

- Withhold federal income tax, Social Security tax, or Medicare tax from employees’ wages.

- Pay wages to employees.

Filing Frequency and Deadlines

Form 941 must be filed quarterly, with specific deadlines for each quarter:

- Quarter 1 (January – March): April 15th

- Quarter 2 (April – June): July 15th

- Quarter 3 (July – September): October 15th

- Quarter 4 (October – December): January 31st of the following year

Businesses must adhere to these deadlines to avoid penalties and interest charges.

s for Form 941

Filling out Form 941, Employer’s Quarterly Federal Tax Return, is crucial for businesses to report and pay their federal taxes accurately. Here’s a comprehensive guide to help you complete Form 941 step-by-step:

Understanding the Form’s Sections

Form 941 consists of several sections, each covering specific aspects of your tax obligations:

– Part 1: Identifies your business, including its name, address, and employer identification number (EIN).

– Part 2: Reports wages, tips, and other compensation paid to employees.

– Part 3: Calculates your federal income tax liability.

– Part 4: Calculates your Social Security and Medicare tax liabilities.

– Part 5: Summarizes your tax payments and any overpayments or underpayments.

– Part 6: Includes additional information, such as your signature and the date the form was filed.

Tips for Accurate Completion

– Gather your records: Ensure you have all the necessary documents, including payroll records, tax tables, and prior tax returns.

– Follow the instructions carefully: Read the instructions thoroughly to understand the requirements for each section.

– Use a calculator: A calculator will help you ensure accurate calculations.

– Double-check your entries: Review your form carefully before submitting it to avoid errors.

– File on time: Submit Form 941 by the due date to avoid penalties.

Downloading the 941 Form

Right, listen up! Need the 941 form? No worries, fam. We got you covered. The official IRS website is your go-to spot for the latest version. Just click on the link below and you’ll be sorted.

Once you’re on the website, you can choose to download the form in PDF or fillable format. If you’re using a computer, the PDF version is fine. But if you want to fill it out on your phone or tablet, go for the fillable format.

And that’s not all! The IRS also offers a bunch of helpful tools to make your life easier. Check out their website for more info on how to download and use the 941 form.

Additional Information

This section provides useful resources and contacts for further assistance with Form 941.

Contact Information

- Internal Revenue Service (IRS): Visit www.irs.gov or call 1-800-829-1040 for general inquiries.

- Electronic Federal Tax Payment System (EFTPS): Enroll online at www.eftps.gov or call 1-800-555-4477 for assistance.

- Electronic Services Center: Get help with online services, including e-filing and account management, by calling 1-800-829-4933.

Recent Updates

The IRS regularly updates Form 941 and its s to reflect changes in tax laws and regulations. It is essential to refer to the most recent version of the form and s to ensure compliance.

FAQ

What is the purpose of Form 941?

Form 941 is used to report and pay federal income tax, Social Security tax, and Medicare tax withheld from employees’ wages.

Who is required to file Form 941?

Businesses and organizations that employ one or more individuals and are subject to federal income tax withholding are required to file Form 941.

When is Form 941 due?

Form 941 is due on the last day of the month following the end of each quarter (April 30, July 31, October 31, and January 31).

Where can I get help with Form 941?

The IRS website provides a wealth of resources, including instructions, FAQs, and contact information for assistance.