Free W9 Form MA Download: A Comprehensive Guide for Contractors and Freelancers

Navigating the complexities of tax compliance can be a daunting task, especially for independent contractors and freelancers. Understanding and utilizing the W9 form is crucial for accurate tax reporting and avoiding potential penalties. In this comprehensive guide, we delve into the world of W9 forms, providing a step-by-step walkthrough, highlighting the benefits, and addressing common concerns. Whether you’re a seasoned contractor or just starting your freelance journey, this guide will equip you with the knowledge and resources to download and use a free W9 form confidently.

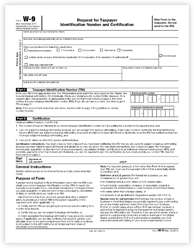

The W9 form, also known as the Request for Taxpayer Identification Number and Certification, is an essential document that collects vital information from individuals or entities receiving payments for services rendered. It serves as a legal record of the recipient’s tax identification number (TIN), which is necessary for the payer to report payments to the Internal Revenue Service (IRS). By providing accurate information on the W9 form, you ensure proper tax withholding and avoid any discrepancies during tax season.

Benefits of Using a Free W9 Form

There are many benefits to using a free W9 form. These benefits include financial savings, time savings, and improved efficiency.

Financial Savings

One of the biggest benefits of using a free W9 form is that it can save you money. When you use a paid W9 form, you will have to pay a fee to the company that provides the form. This fee can range from a few dollars to several hundred dollars. By using a free W9 form, you can avoid these fees and save money.

Time Savings

Another benefit of using a free W9 form is that it can save you time. When you use a paid W9 form, you will have to spend time filling out the form and submitting it to the company that provides the form. This can take several minutes or even hours. By using a free W9 form, you can avoid this hassle and save time.

Improved Efficiency

Finally, using a free W9 form can help you improve your efficiency. When you use a paid W9 form, you will have to keep track of the forms that you have submitted and the payments that you have made. This can be a time-consuming and error-prone process. By using a free W9 form, you can avoid this hassle and improve your efficiency.

Considerations When Using a Free W9 Form

Using a free W9 form can be a great way to save time and money, but it’s important to be aware of the security and legal implications before you do so.

Security Considerations

When using a free W9 form, it’s important to be aware of the security risks involved. These risks include:

- The form could be fraudulent, and the information you provide could be used to steal your identity or your money.

- The form could be infected with malware, which could damage your computer or steal your personal information.

- The form could be shared with third parties without your knowledge or consent.

Legal Implications

Using a free W9 form can also have legal implications. These implications include:

- The form may not be valid, and you could be held liable for any errors or omissions on the form.

- The form may not comply with all applicable laws, and you could be fined or penalized for using it.

- The form may not be accepted by the IRS, and you could be required to file a corrected W9 form.

Tips for Using a Free W9 Form Safely and Securely

To use a free W9 form safely and securely, you should follow these tips:

- Only download W9 forms from reputable sources.

- Review the form carefully before you fill it out.

- Make sure the form is complete and accurate.

- Keep a copy of the form for your records.

- File the form with the IRS as soon as possible.

Common Queries

Where can I find a reputable website to download a free W9 form?

The IRS website (www.irs.gov) provides a free and official W9 form that you can download and print.

What are the different formats available for free W9 forms?

W9 forms are typically available in PDF, fillable PDF, and printable formats. Choose the format that best suits your needs.

Is it safe to use a free W9 form?

Yes, as long as you obtain the form from a reputable source such as the IRS website. Avoid downloading forms from untrustworthy websites or sharing your personal information with unknown entities.