Free Form 1040 Ct Download: A Comprehensive Guide to Filing Your Connecticut Taxes

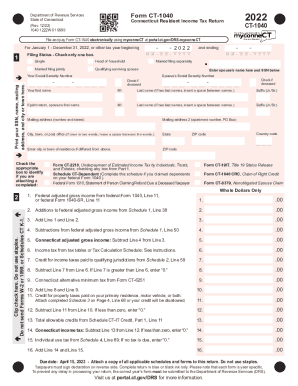

Filing your Connecticut state income taxes can be a daunting task, but it doesn’t have to be. With the Free Form 1040 Ct Download, you can easily access the necessary forms and instructions to file your taxes accurately and on time. In this guide, we will provide you with a step-by-step walkthrough of the Form 1040 CT, including its structure, sections, and how to complete it.

The Form 1040 CT is designed to help you report your income, deductions, and credits for the state of Connecticut. By understanding the form and following the instructions carefully, you can ensure that your taxes are filed correctly and avoid any potential penalties or delays.

Free Form 1040 Ct Download

Blimey, guv’nor! If you’re after a right giggle, you’ve come to the right caff. We’ve got the lowdown on how to download Form 1040 CT, the cheeky little form that’ll help you dodge the taxman and keep your dosh where it belongs – in your pocket, mate.

So, grab a cuppa and put your feet up, ’cause we’re about to take you on a jolly good journey through the wonderful world of tax forms. Let’s get this shebang started, shall we?

Step-by-Step Guide to Downloading Form 1040 CT

- Head over to the official IRS website: Type “IRS.gov” into your browser’s address bar and hit enter. You’ll be greeted by a spiffing website that’s chock-full of all the tax info you could ever want.

- Find the Forms & Pubs section: Once you’re on the IRS website, look for the “Forms & Pubs” tab at the top of the page. Hover your mouse over it and a drop-down menu will appear.

- Select “Forms”: From the drop-down menu, click on “Forms.” This will take you to a page that lists all the forms the IRS has to offer.

- Search for Form 1040 CT: In the search bar at the top of the page, type “Form 1040 CT.” The search results will show you a list of all the different versions of Form 1040 CT that are available.

- Choose the correct version: Select the version of Form 1040 CT that is right for you. If you’re not sure which version to choose, you can consult the instructions for Form 1040 CT.

- Download the form: Once you’ve selected the correct version of Form 1040 CT, click on the “Download” button. The form will be downloaded to your computer in PDF format.

Understanding Form 1040 CT

Form 1040 CT is a tax return form used by Connecticut residents to file their state income taxes. The form is divided into several sections, each of which collects specific information about your income, deductions, and credits.

The first section of the form is the “Identification” section. This section collects basic information about you, such as your name, address, and Social Security number. The second section is the “Income” section. This section collects information about your income from all sources, including wages, salaries, tips, and investments. The third section is the “Deductions” section. This section collects information about your deductible expenses, such as mortgage interest, property taxes, and charitable contributions. The fourth section is the “Credits” section. This section collects information about your tax credits, such as the earned income tax credit and the child tax credit. The fifth section is the “Tax” section. This section calculates your tax liability based on the information you provided in the previous sections. The sixth section is the “Payments” section. This section collects information about your tax payments, such as estimated tax payments and withholding taxes. The seventh section is the “Refund or Balance Due” section. This section calculates your refund or balance due based on the information you provided in the previous sections.

- Section 1: Identification

- Section 2: Income

- Section 3: Deductions

- Section 4: Credits

- Section 5: Tax

- Section 6: Payments

- Section 7: Refund or Balance Due

Completing Form 1040 CT

Filling out Form 1040 CT can be a bit of a faff, but it’s important to get it right. Here’s a quick guide to help you fill out each section of the form accurately.

Personal Information

Start by filling out your personal information, including your name, address, and Social Security number. Make sure your info matches what’s on your other tax documents, like your W-2s.

Income

Next, you’ll need to report your income. This includes wages, salaries, tips, and any other taxable income you received during the year. If you’re self-employed, you’ll need to fill out Schedule SE to calculate your self-employment tax.

Adjustments to Income

After you’ve reported your income, you can subtract certain adjustments to reduce your taxable income. These adjustments include things like student loan interest, alimony payments, and certain retirement contributions.

Taxable Income

Your taxable income is your total income minus any adjustments to income. This is the amount of income that’s subject to tax.

Tax

Once you’ve calculated your taxable income, you can figure out how much tax you owe. The tax rates vary depending on your filing status and income. You can use the tax tables in the instructions to find your tax liability.

Credits

After you’ve calculated your tax, you can claim any tax credits that you’re eligible for. Credits reduce your tax liability dollar for dollar. Some common credits include the child tax credit, the earned income tax credit, and the saver’s credit.

Payments

Finally, you’ll need to report any payments you’ve made towards your taxes. This includes withholding from your paycheck, estimated tax payments, and any other payments you’ve made. If you’ve overpaid your taxes, you’ll get a refund. If you owe taxes, you’ll need to pay the balance due.

Filing Form 1040 CT

Yo, listen up! It’s time to get real about filing your Form 1040 CT. This ain’t no joke, fam. You gotta do it right, or else you might end up in hot water.

There are a few ways you can file your 1040 CT. You can do it online, by mail, or through a tax preparer. If you’re feeling confident, you can do it yourself. But if you’re not sure what you’re doing, it’s best to leave it to a pro.

Deadlines and Extensions

The deadline for filing your 1040 CT is April 15th. But if you need more time, you can file for an extension. This will give you until October 15th to get your return in. Just be sure to file for the extension before April 15th, or you’ll be hit with penalties.

Consequences of Late Filing

If you file your 1040 CT late, you’ll have to pay penalties and interest. The penalties can be pretty hefty, so it’s best to avoid them if you can. If you’re having trouble filing on time, contact the Connecticut Department of Revenue Services for help.

Additional Resources

Looking for more info on Form 1040 CT? We gotchu covered, bruv.

From official IRS publications to savvy tax software and even some pro tax peeps, we’ve got links to everything you need to ace that tax return.

IRS Publications

Tax Software

Tax Professionals

Need some extra help? Here’s a few tax pros who can give you a hand:

- The Connecticut Society of Certified Public Accountants: https://www.ctcpa.org/

- The Connecticut Bar Association: https://www.ctbar.org/

- The Connecticut Department of Revenue Services: https://portal.ct.gov/DRS/

Frequently Asked Questions

Where can I download the Free Form 1040 Ct?

You can download the Free Form 1040 Ct from the official Connecticut Department of Revenue Services website.

What are the deadlines for filing Form 1040 Ct?

The deadline for filing Form 1040 Ct is April 15th. However, if you file an extension, you have until October 15th to file.

What are the penalties for late filing?

There are penalties for late filing, so it is important to file your taxes on time. The penalty for late filing is 5% of the unpaid tax for each month or part of a month that your return is late, up to a maximum of 25%.