Free Colorado W4 Form 2024 Download: A Comprehensive Guide for Accurate Tax Withholding

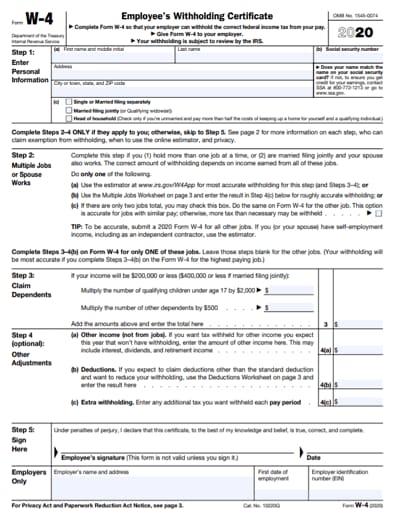

Navigating the complexities of tax withholding can be daunting, but it’s crucial for ensuring accurate tax payments and avoiding penalties. For Colorado residents, the Free Colorado W4 Form 2024 Download is an essential tool that simplifies this process. This comprehensive guide will provide you with a clear understanding of the purpose, benefits, and step-by-step instructions for downloading and completing the form. Additionally, we’ll delve into the importance of Colorado tax withholding, discuss updates for the 2024 tax year, and offer valuable resources to assist you throughout the process.

Whether you’re a seasoned taxpayer or filing your taxes for the first time, this guide will empower you with the knowledge and resources you need to complete your Colorado W4 form with confidence. By understanding the nuances of tax withholding and utilizing the Free Colorado W4 Form 2024 Download, you can ensure that your tax payments are accurate, minimizing the risk of overpayments or underpayments.

Free Colorado W4 Form 2024 Download

Blud, if you’re a wage slave in Colorado, listen up. The Free Colorado W4 Form 2024 is your ticket to getting your taxes sorted, innit? This bad boy is the official form you need to give your employer so they can take the right amount of tax out of your pay packet each month. It’s like a cheat code for avoiding any aggro with the taxman.

Downloading the form is a doddle. Just hit the link below, and you’re golden. Once you’ve got it, you can fill it in on your laptop or print it out and scribble on it like a right old geezer. Just make sure you fill it in properly, or you might end up paying too much tax, which is a right bummer.

Step-by-Step Guide

- Click the link below to download the Free Colorado W4 Form 2024.

- Open the form in a PDF reader like Adobe Acrobat Reader.

- Fill in the form with your personal information, including your name, address, and Social Security number.

- Follow the instructions on the form to calculate your withholding allowances.

- Sign and date the form.

- Give the completed form to your employer.

Tips for Completing the Form

- Use the IRS Withholding Calculator to help you calculate your withholding allowances.

- If you have multiple jobs, you may need to complete a separate W4 form for each employer.

- If you have any questions about completing the form, you can contact the IRS for assistance.

Colorado Tax Withholding

Paying the correct amount of taxes is crucial to avoid penalties and interest charges. Colorado has its own set of tax laws and withholding requirements that employers must follow when deducting taxes from employees’ paychecks.

Methods for Calculating Colorado State Income Tax

There are two main methods for calculating Colorado state income tax:

- Percentage Method: This method uses a flat percentage rate applied to your taxable income. The percentage rate varies depending on your filing status and income level.

- Bracket Method: This method divides your taxable income into different brackets, each with its own tax rate. The tax you owe is calculated by applying the appropriate rate to each bracket.

Adjusting Withholding Allowances

The W4 form allows you to adjust your withholding allowances, which can affect the amount of taxes withheld from your paycheck. Each allowance represents a certain amount of income that is not subject to withholding. By increasing or decreasing your allowances, you can adjust the amount of taxes withheld to ensure you’re not overpaying or underpaying.

To adjust your withholding allowances, follow these steps:

- Complete the W4 form provided by your employer.

- Enter your personal information, including your name, address, and Social Security number.

- In the “Allowances” section, enter the number of allowances you claim. Refer to the IRS instructions for guidance on determining your allowances.

- Sign and date the form.

- Submit the completed W4 form to your employer.

By accurately withholding taxes, you can avoid surprises at tax time and ensure you’re fulfilling your tax obligations.

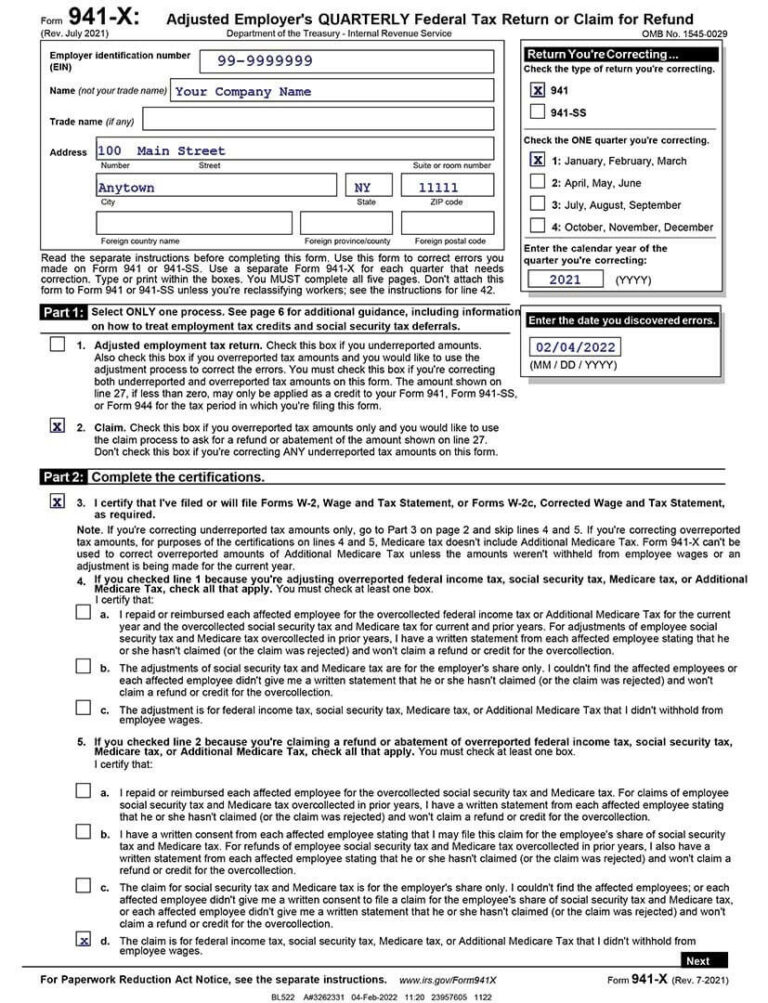

2024 Tax Year Updates

The Colorado W4 form for the 2024 tax year has undergone several important changes. These updates aim to simplify the withholding process and ensure accurate tax calculations for Colorado residents.

One significant change is the introduction of a new line for taxpayers to indicate their “Colorado residency status.” This line allows taxpayers to specify if they are a full-year resident, part-year resident, or nonresident. This information is crucial for determining the correct withholding amount, as residency status affects the calculation of state income tax.

Colorado Residency Status

- Full-year resident: A taxpayer who has lived in Colorado for the entire tax year (January 1st to December 31st).

- Part-year resident: A taxpayer who has lived in Colorado for only a portion of the tax year.

- Nonresident: A taxpayer who has not lived in Colorado for any part of the tax year.

Another change is the inclusion of a line for taxpayers to claim the “Colorado Child Tax Credit.” This credit is available to taxpayers who have qualifying children under the age of 18. The credit amount varies depending on the number of qualifying children and the taxpayer’s income.

Colorado Child Tax Credit

- Qualifying child: A child under the age of 18 who meets certain requirements, such as being a U.S. citizen or resident alien.

- Credit amount: The credit amount ranges from $50 to $500 per qualifying child, depending on the taxpayer’s income.

Taxpayers should carefully review the 2024 Colorado W4 form and make any necessary adjustments to their withholding calculations. These changes are designed to improve the accuracy of withholding and help taxpayers avoid overpaying or underpaying their state income taxes.

Additional Resources

We’re buzzin’ with more ways to get the lowdown on Colorado taxes.

Not sure where to start? Check out these banging resources:

Colorado Department of Revenue Website

- The Colorado Department of Revenue website is your one-stop shop for all things tax-related.

- Find forms, instructions, and calculators to help you ace your taxes.

- Get answers to your burning tax questions and stay up-to-date on the latest tax news.

Tax Preparation Software

Tax preparation software can take the pain out of doing your taxes.

- These programs guide you through the process step-by-step.

- They can help you maximize your deductions and credits.

- Some even offer free versions for simple returns.

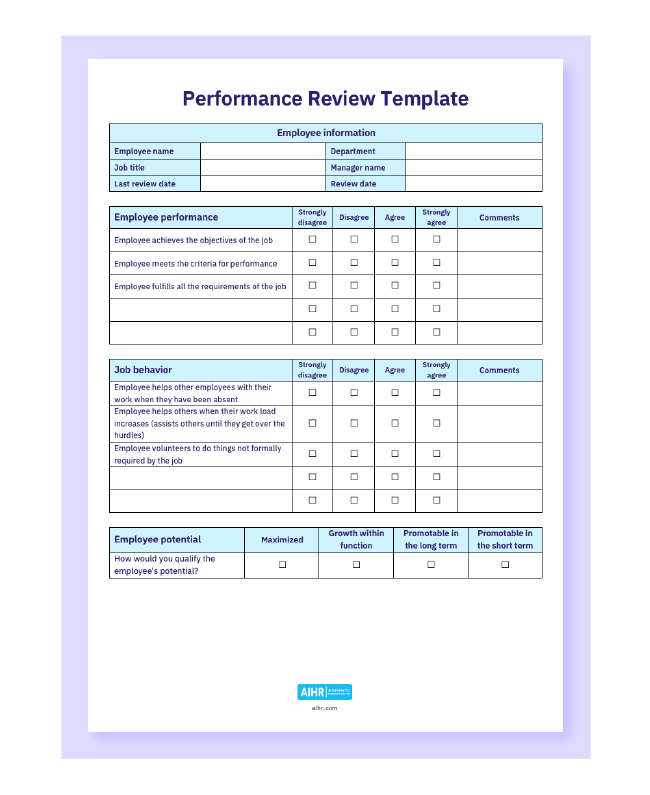

Professional Tax Help

If you’re feeling overwhelmed, don’t fret.

- Reach out to a professional tax preparer for expert guidance.

- They can help you navigate the complexities of the tax code and ensure you’re paying the right amount.

- Just be sure to do your research and find a reputable preparer.

FAQ

What is the purpose of the Free Colorado W4 Form 2024 Download?

The Free Colorado W4 Form 2024 Download is a fillable PDF form used by Colorado residents to provide their employer with instructions on how much federal income tax to withhold from their paychecks. It helps ensure that the appropriate amount of taxes is withheld, minimizing the risk of overpayments or underpayments.

How do I download the Free Colorado W4 Form 2024?

You can download the Free Colorado W4 Form 2024 from the Colorado Department of Revenue website. The form is available in both English and Spanish.

What are the key changes to the Colorado W4 form for the 2024 tax year?

There are no significant changes to the Colorado W4 form for the 2024 tax year. However, it’s always a good idea to review the form each year to ensure that your withholding allowances are still accurate.

Where can I find additional resources for Colorado taxpayers?

The Colorado Department of Revenue website offers a variety of resources for taxpayers, including tax forms, instructions, and publications. You can also find information on tax filing deadlines and other important dates for Colorado residents.