Free 5329-t Form Download: A Comprehensive Guide

Navigating the world of tax forms can be a daunting task, but understanding and accessing the Form 5329-t is crucial for ensuring accurate tax reporting. This comprehensive guide will provide you with all the essential information you need to download, complete, and submit Form 5329-t with ease.

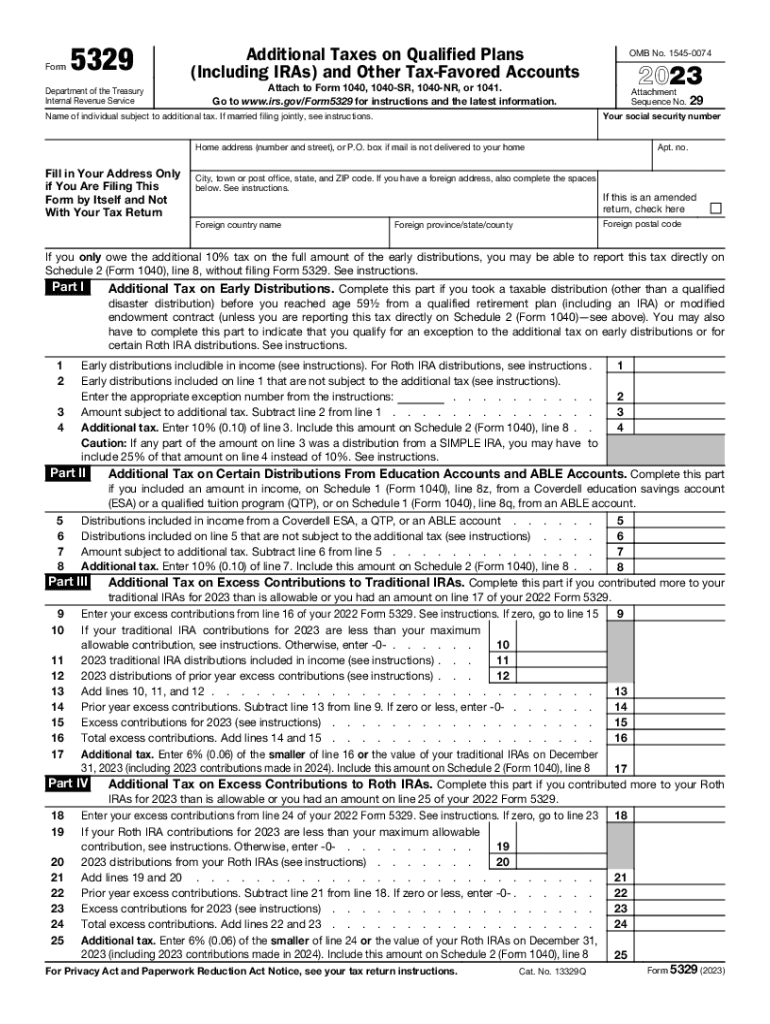

Form 5329-t, also known as the Additional Tax on IRAs, Other Qualified Retirement Plans, Annuities, Modified Endowment Contracts, and MSA Distributions, is an important tax form used to report distributions from retirement accounts. Understanding the purpose and usage of this form is vital for proper tax compliance.

Form Overview

The 5329-t Form, also known as the "Vehicle Information Form", is an official document used to record and transfer essential information about a specific motor vehicle. This form serves as a vital tool in various scenarios, including vehicle registration, insurance claims, and legal proceedings.

The origins of the 5329-t Form can be traced back to the early days of automobile regulation. As the number of vehicles on the road increased, the need arose for a standardized method of documenting and tracking vehicle-related information. The 5329-t Form emerged as a comprehensive solution to this challenge.

Purpose

The primary purpose of the 5329-t Form is to provide a detailed and accurate record of a vehicle’s key characteristics and ownership history. This information is crucial for various purposes, such as:

- Vehicle registration: The 5329-t Form serves as a central repository for information required for vehicle registration, including make, model, year, VIN, and ownership details.

- Insurance claims: In the event of an accident or other incident, the 5329-t Form provides insurance companies with essential details about the vehicle involved, facilitating the claims process.

- Legal proceedings: The 5329-t Form can serve as evidence in legal disputes involving vehicle ownership, accidents, or other related matters.

Downloading the Form

Getting your hands on Form 5329-t is a doddle. Simply head to the official website of the Internal Revenue Service (IRS), the big cheese when it comes to tax matters in the US. Once you’re there, navigating the site is a piece of cake.

Official Website

On the IRS website, keep your eyes peeled for the search bar. Type in “Form 5329-t” and hit enter. Voila! You’ll be taken to a page dedicated to the form.

Alternative Methods

If you’re not feeling the digital vibe, you can also get your mitts on Form 5329-t by post. Just scribble down a request to the IRS and pop it in the mail. They’ll send you a spanking new form in no time.

Form Structure and Content

Yo, check this out, Form 5329-t is a pretty straightforward bit of biz. It’s set up like this:

It’s got two parts: the top half is for your basic info, like name, addy, and all that jazz. The bottom half is where you get down to the nitty-gritty, filling in details about your income, expenses, and any other financial shebangs.

Key Sections and Fields

Let’s break it down, shall we?

- Part I: Personal Information – This is where you spill the beans on who you are and where you’re at.

- Part II: Income – Time to show off your earnings. This section is all about the dough you’re raking in from wages, investments, and any other sources.

- Part III: Adjustments to Income – Here’s where you can claim any deductions or credits that might lower your taxable income.

- Part IV: Tax Computation – This is the part where the magic happens. The form calculates your tax liability based on your income and any applicable deductions and credits.

- Part V: Tax Payments – In this section, you’ll record any taxes you’ve already paid, like through withholding or estimated payments.

- Part VI: Refund or Amount You Owe – The final showdown! This section tells you if you’re getting a refund or if you owe more tax.

Filling Out the Form

Yo, filling out this form might seem like a right pain, but don’t fret, fam. We’ve got you covered. Here’s a sick guide to help you navigate this paperwork like a pro.

Make sure you’ve got all the deets you need before you start. It’s a bit like going into battle, you need your arsenal ready. So, gather up any documents, IDs, or bits of info that might be relevant.

Now, let’s dive into the form itself. Each section is like a different level in a game, so let’s break it down, innit?

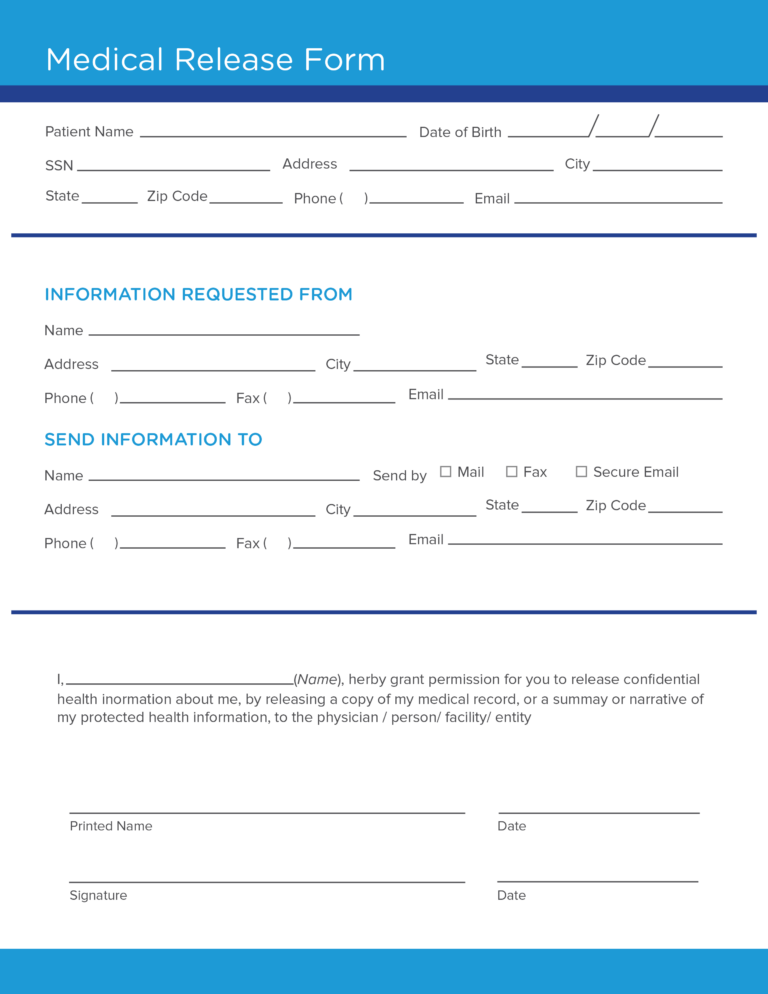

Personal Information

This bit’s easy peasy. Just chuck in your basic info like name, address, and contact details. Make sure it’s all squeaky clean and up-to-date, or you might end up getting lost in the system.

Contact Information

Here’s where you tell them how to reach you if they’ve got any questions or need to drop you a line. Make sure you give them a reliable phone number and email address. Don’t be like, “Oh, just text me on my burner,” or they’ll think you’re a bit of a sket.

Reason for Applying

This is your chance to tell them why you’re after whatever it is you’re applying for. Be clear and concise, and don’t waffle on. Keep it simple, like a well-cooked steak.

Supporting Documents

If there’s any extra info you need to provide, like proof of income or a letter of reference, this is where you attach it. Make sure you’ve got everything they’ve asked for, or you might get a right royal telling off.

Common Errors

Watch out for these common pitfalls when filling out the form:

- Missing info: Don’t leave any fields blank. If you’re not sure what to put, just write “N/A.”

- Typos: Double-check your details before you hit submit. Any mistakes could delay your application.

- Unclear handwriting: If you’re filling out the form by hand, make sure your writing is legible. The person reading it might not be able to decipher your chicken scratch.

- Forgetting to sign: Don’t forget to sign the form at the end. Without your signature, it’s not valid.

There you have it, my friends. Filling out the form doesn’t have to be a nightmare. Just follow these steps, and you’ll be sorted in no time. Good luck!

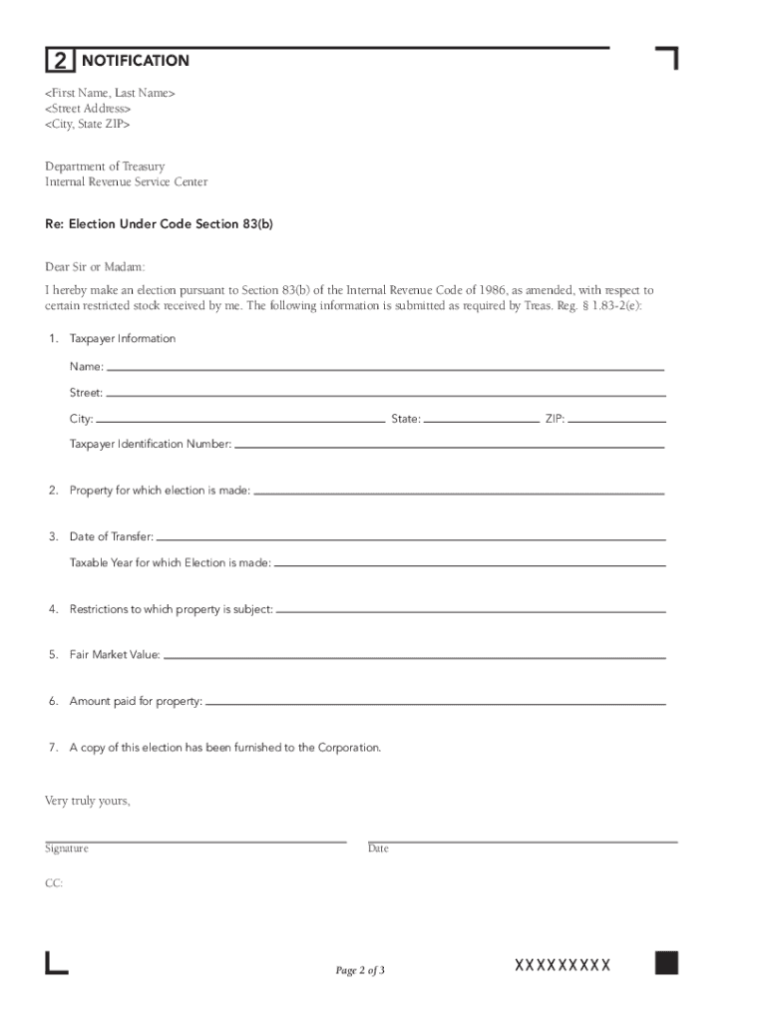

Submitting the Form

Submitting the completed 5329-t form is a crucial step to ensure your request is processed efficiently. Several options are available for submission, each with its own advantages and deadlines.

Mailing the Form

For a traditional approach, you can mail the completed form to the designated address provided by the relevant authority. Ensure you use the correct address and include all necessary supporting documentation to avoid delays in processing.

Submitting Electronically

For a more convenient option, you can submit the form electronically through a secure online portal or email. This method is often faster and allows you to track the progress of your submission. Check the official website or contact the relevant authority for specific instructions on electronic submission.

Deadlines and Timeframes

It’s important to adhere to the specified deadlines for form submission. Late submissions may result in delays or even rejection of your request. Check the official guidelines or contact the relevant authority for the exact submission deadlines applicable to your situation.

Resources and Support

Need some extra help with Form 5329-t? Check out these resources and don’t be afraid to reach out if you’re still stuck.

The IRS website has a dedicated page for Form 5329-t, where you can find instructions, FAQs, and other helpful info.

Contact Information

- IRS Helpline: 1-800-829-1040

- Email: [email protected]

Online Communities

Connect with other folks who are also filling out Form 5329-t on online forums like Reddit and Bogleheads. You can share tips, ask questions, and learn from others’ experiences.

FAQ

Where can I download Form 5329-t?

You can download Form 5329-t from the official IRS website at www.irs.gov/forms-pubs/about-form-5329.

What is the purpose of Form 5329-t?

Form 5329-t is used to report distributions from retirement accounts, such as IRAs, 401(k) plans, and annuities.

When is Form 5329-t due?

Form 5329-t is due on April 15th of the year following the year in which the distribution was made.